If you are considering investing in Kenya, you may be familiar with Treasury bonds.

However, even though Treasury bonds are a popular choice, there are other possibilities for Kenyans to invest in. In this post, we will compare Kenya’s Treasury Bonds with a range of alternative investment options to assist you in making an investment decision.

First, let’s take a careful look at treasury bonds. The Kenyan government is offering these debt instruments to collect money for public projects.

They’re considered a reasonably safe investment because the government backs them with its whole faith and credit.

Treasury bonds often have longer maturities than treasury bills, ranging from two to thirty years, and they pay a fixed interest rate.

Although Treasury bonds are a popular investment option, not everyone will find them to be the best fit. Depending on your investing goals and risk tolerance, you may also want to consider other options like stocks, mutual funds, or real estate.

Due diligence is essential because every investment decision has pros and cons.

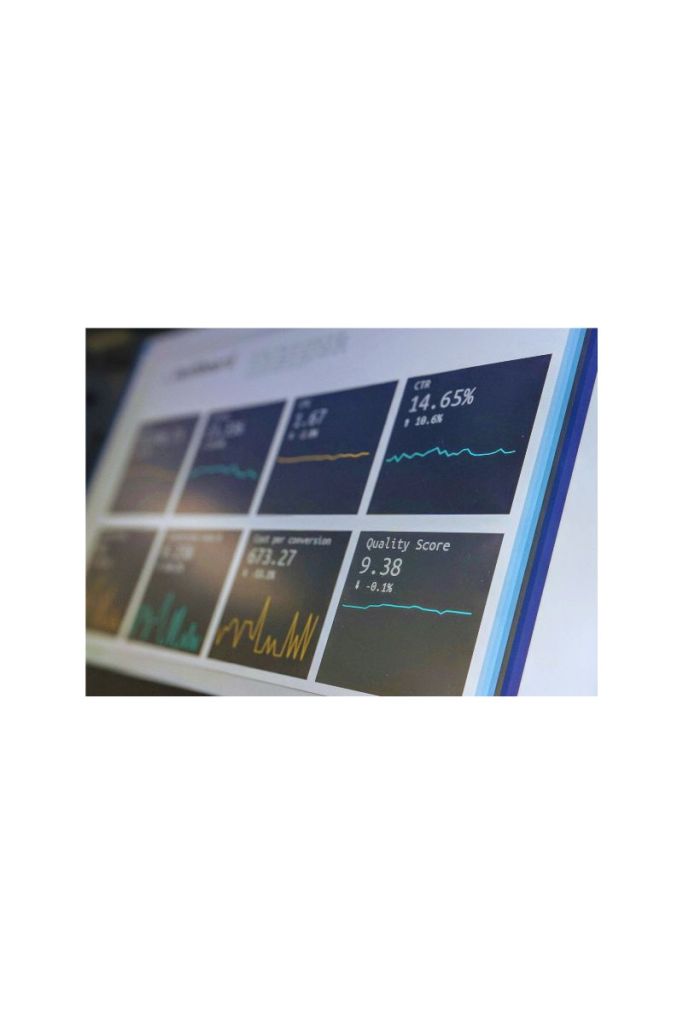

Here is a Visual Representation of this Comparative Analysis

| Investment Option | Return on Investment | Liquidity | Investment Security | Tax Considerations |

|---|---|---|---|---|

| Treasury Bonds | Modest | Low | High | Tax-free interest, Capital gains tax on early sale (5%) |

| Stock Market | Potentially high | High | Variable | Capital gains tax (5%), Dividend withholding tax (10%) |

| Real Estate | Potentially high | Low | Variable | Capital gains tax (5%), Income tax on rental income (10%) |

| Savings Accounts | Modest | High | High | Variable, modest rewards |

| Corporate Bonds | Modest | Moderate | Moderate | Capital gains tax (5%), Dividend withholding tax (10%) |

Table of Contents

Overview of Kenya’s Treasury Bonds. 4

Characteristics of Treasury Bonds. 4

Investment Options in Kenya. 5

Tax Considerations for Investors. 8

Investor Profiles and Suitability. 9

Conservative vs. Aggressive Investors. 11

Short-Term vs. Long-Term Goals. 11

Effect on the National Economy. 11

Influence on Personal Wealth. 12

Overview of Kenya’s Treasury Bonds

Treasury Bonds are the best option if you’re looking for a low-risk investment option in Kenya.

The Central Bank of Kenya, on behalf of the Kenyan government, issues Treasury Bonds, which are thought to be a secure investment option. In this section, we will examine their characteristics, such as interest rates, maturity dates, and risk profiles.

Characteristics of Treasury Bonds

Treasury Bonds are long-term debt securities issued by the Kenyan government. Their interest rate is fixed, and their maturity lengths vary from one to thirty years.

Many investors can purchase Treasury Bonds, with denominations beginning at KES 50,000.

Interest Rates and Maturity Periods

Treasury Bonds are auctioned, with investors’ bids determining the bond’s interest rate. The Central Bank of Kenya sets a minimum bid price, and the bonds are given to the highest bidders at that price.

Because Treasury Bonds often have higher interest rates than Treasury Bills, they are a more appealing option for investors looking to make more significant gains.

Treasury bonds have maturities ranging from one to thirty years, and longer-term bonds typically have higher interest rates.

Longer-term bonds are also riskier because they are more susceptible to changes in interest rates and inflation.

Risk Profile

Treasury Bonds are considered a low-risk investment option since they are issued by the Kenyan government and backed by its full faith and credit.

However, Treasury Bonds are not risk-free investments like any other. The main risk associated with Treasury bonds is interest rate risk or the potential for interest rates to increase and reduce the bond’s value.

Treasury Bonds are frequently a safe alternative for Kenyans seeking a low-risk, long-term investment solution.

Their stable income rates, long maturity periods, and low-risk profile make them attractive to institutional and private investors.

Investment Options in Kenya

There are several options available to you regarding investing in Kenya. It is essential to consider each option’s advantages and disadvantages before deciding.

Some of the most popular investment options in Kenya are as follows:

Stock Market

In Kenya, stock market investing is one of the most popular options. It involves buying and selling shares in publicly traded companies.

Nairobi Securities Exchange (NSE) is Kenya’s leading stock exchange. Investing in the stock market has some risk, but it also has the potential to yield significant profits.

It’s essential to do extensive research and understand as much as possible about the companies you’re investing in before making any decisions.

Real Estate

Real estate is yet another popular investment option in Kenya. It involves buying property to rent out or make a profit.

Real estate can be a prudent long-term investment since properties often appreciate over time.

However, it might also be risky because of the possibility of price volatility and the usually exorbitant transaction fees.

Savings Accounts

Savings accounts are a low-risk investment option in Kenya. They consist of depositing money into a bank account and progressively earning interest.

Savings accounts have lower risk even though they offer modest rewards.

They are an excellent option for people who want to set aside money for a specific goal, such as a child’s education expenses or a down payment on a house.

Corporate Bonds

Corporate bonds are an extra investment option available in Kenya. They comprise lending money to a company in exchange for regular interest payments and the principal amount being reimbursed when the bond matures.

Corporate bonds may be a good choice for an investor seeking a fixed income stream ready to take on some risk.

Nonetheless, you should perform due investigation and determine the organisation’s creditworthiness before investing.

Kenya generally offers an extensive array of investment opportunities. Before making a decision, it is essential to consider each option’s advantages and disadvantages.

Whether you want to invest in stocks, real estate, corporate bonds, savings accounts, or other assets, you must research and make informed decisions.

Comparative Analysis

Return on Investment

Treasury Bonds are seen as a dependable and secure investment choice in Kenya. However, it’s crucial to remember that, compared to other investing options, Treasury Bonds offer a very modest return on investment.

For instance, investing in real estate or the stock market involves a higher degree of risk but may result in more significant rewards.

Liquidity Comparison

Treasury Bond investments are typically considered long-term investments because their maturities might be anywhere from one to thirty years away.

This indicates that since selling your bonds before they mature can be challenging, it might not be the most liquid investment choice.

Conversely, other investment options, like stocks or mutual funds, are more liquid because they are easier to buy and sell.

Investment Security

One key advantage of investing in Treasury bonds is the excellent degree of security they provide.

Because the government backs Treasury Bonds, they are considered low-risk investment alternatives.

On the other hand, the value of different investment options, like stocks or real estate, may be subject to market fluctuations, making them more volatile.

Market Volatility

Treasury Bonds are not immune to market volatility even though they are typically considered low-risk investments.

Treasury Bond values are susceptible to fluctuations in interest rates and economic conditions, which may reduce the return on investment.

Nonetheless, Treasury Bonds are still a reasonably stable choice compared to other investment opportunities like stocks or real estate.

Overall, it’s critical to consider aspects like return on investment, liquidity, investment security, inflation and market volatility when contrasting Kenya’s Treasury Bonds with alternative investment possibilities.

Even if they might not yield the highest profits, Treasury Bonds are nevertheless regarded as a dependable and safe investment choice, particularly for individuals seeking a low-risk,

Tax Considerations for Investors

Taxes are a significant factor to consider while investing. Treasury bond investments and other investment alternatives have various tax effects in Kenya.

This section will examine the tax implications for investors in Kenya.

Treasury Bonds Taxation

In Kenya, Treasury bond investments are tax-free, meaning the interest you receive on your investment is tax-free.

However, you must pay capital gains tax if you sell your Treasury bonds before they mature. Kenya has a 5% capital gains tax.

Other Investments Taxation

Capital gains tax applies to other investment alternatives in Kenya, including equities and mutual funds.

Kenya levies a 5% capital gains tax on equities and mutual funds. Dividends from mutual funds and equities are furthermore liable to withholding tax.

Ten per cent is Kenya’s dividend withholding tax rate.

In Kenya, taxes also apply to real estate investments. You must pay capital gains tax on any property you sell within three years of buying it.

The capital gains tax rate on real estate in Kenya is 5%. Income tax also applies to rental income derived from real estate. In Kenya, 10% of rental income is subject to income tax.

Investor Profiles and Suitability

Before considering investing in Kenyan Treasury Bonds or any other kind of investment, make sure you are a suitable investor. T

his covers your time horizon, investing goals, and risk tolerance.

Conservative vs. Aggressive Investors

Conservative investors prefer low-risk assets, placing a high priority on capital preservation. They are prepared to accept lesser returns to increase their assurance that they will meet their investment objectives.

Because they have little default risk and are backed by the Kenyan government, Treasury Bonds make sense for conservative investors.

Conversely, aggressive investors are prepared to assume more risks to earn potentially more significant profits.

They give capital preservation less weight than capital appreciation. Stocks and mutual funds are two more investing options that aggressive investors might favour.

Short-Term vs. Long-Term Goals

Investors with short maturities, like Treasury Bills, may prefer investments with short maturities. These investments may be suitable for short-term objectives such as saving for a child’s education or a down payment on a home.

Treasury Bills can offer a reliable source of income for a brief period and have maturities ranging from 91 days to one year.

Investors with long-term objectives like retirement planning may prefer Treasury Bonds and other longer-term investments. Treasury Bonds can offer a consistent income stream for longer and have maturities ranging from two to thirty years.

It’s crucial to remember that every investment carries risks. Investors should always conduct due research and speak with a financial counsellor before making any investment decisions.

Economic Impact

Effect on the National Economy

Purchasing Treasury Bonds from Kenya is an excellent method to support the nation’s economic expansion.

A study by Koka (2019) found that the performance and issuance of government bonds significantly favourable influence Kenya’s economic growth.

The government gets a large amount of funding from the bond market, which it can utilise for infrastructure and development initiatives.

Consequently, purchasing treasury bonds contributes to funding government initiatives, which may benefit the nation’s economy.

Additionally, when Kenya’s bond market grows, it may result in more price discovery and liquidity necessary to use available resources effectively.

According to a 2015 KIPPRA assessment, to improve the bond market’s liquidity, steps must be taken toward creating an active money market with price fixing determined by the market.

This may result in a more efficient market and use of resources, both of which could benefit the nation’s economy as a whole.

Influence on Personal Wealth

Purchasing Treasury Bonds issued by Kenya might potentially increase one’s wealth. Treasury bonds are a comparatively low-risk investment choice that can yield a consistent income stream.

A Kenyan Treasury bond requires a minimum investment of KES 50,000, whilst a bill requires a minimum investment of KES 100,000.

You must have a CDS account to purchase Kenyan Treasury bonds (LinkedIn, n.d.). A set rate of return is another feature of Treasury bonds that can give investors a steady flow of income.

Furthermore, purchasing Treasury bonds can spread out your investment portfolio. A hedge against inflation and other economic risks, such as those posed by Treasury bonds, can help safeguard your entire investment portfolio.

Purchasing Treasury Bonds protects your financial future and promotes economic growth.

Conclusion

In conclusion, contrasting Kenyan Treasury Bonds with alternative investment options reveals that they provide a special set of advantages.

First, Treasury Bonds are a safe investment choice because the Kenyan government backs them. Second, they provide flexibility regarding the length of the investment.

Treasury Bonds come in a range of terms, from two to thirty years, so you may pick an investment period that works for your budget.

Furthermore, those looking for safe and reliable investment solutions may find that purchasing Treasury Bonds is prudent.

Interest rates on Treasury Bonds are competitive and typically higher than those on savings accounts and fixed deposits. Furthermore, Treasury Bonds are tax-exempt so that you can retain more money.

Other investment possibilities include stocks, mutual funds, and real estate, each with its dangers and difficulties.

Mutual funds and stocks are prone to market fluctuations, whereas real estate investments demand substantial financial resources and specialised knowledge. Conversely, Treasury Bonds are a low-risk option for long-term investing that can yield consistent profits.

Kenyan Treasury Bonds are an excellent alternative if you’re searching for a safe, reliable investment solution with competitive yields.

Treasury Bonds have the might of the Kenyan government behind them, flexible investment periods, and tax-exempt status to help you reach your financial objectives.

Leave a comment