Treasury Bonds and How to make money with them in Kenya

Treasure bonds are medium to long-term investments offering interest payments after six months. So you will be receiving your interest payments twice a year.

Table of Contents

How to buy treasury bonds in Kenya. 1

What you need to know if you want to invest in treasury bonds. 2

What is the interest rate on Treasury bonds in Kenya? T bill rates Kenya. 4

Minimum amount to invest in treasury bonds in Kenya. 5

How do Treasury bonds make money in Kenya? How do you profit from Treasury bonds?. 5

What are the disadvantages of investing in Treasury bills?. 5

Are Treasury bonds a good investment in Kenya?. 5

How to open a CDS account while in the diaspora. 6

Difference between T Bills and Bonds. 6

How To Make Money from Treasury Bonds in Kenya

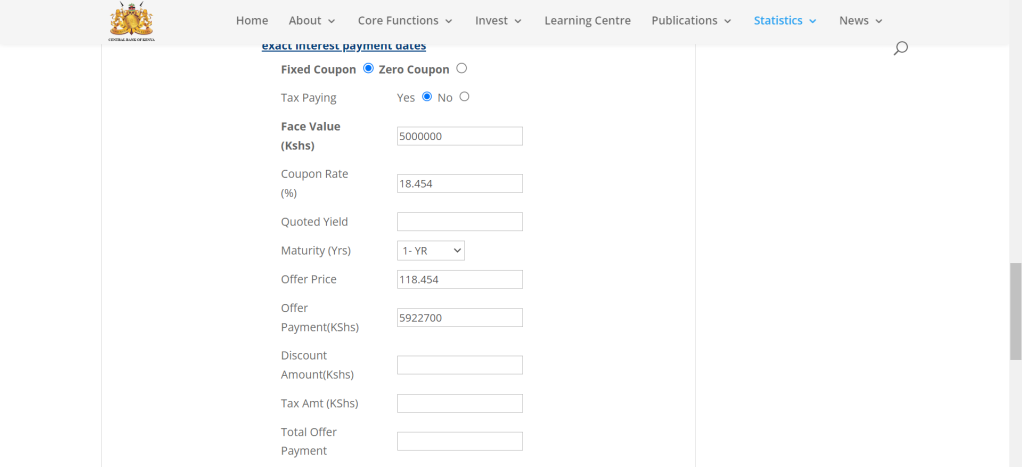

The Kenya 10 Years Government Bond has a 18.454% yield (last update 3 Jan 2024 0:17 GMT+0).

Let’s calculate how much you would make with government treasury bonds using the Central Bank of Kenya Treasury/ Infrastructure Bonds Pricing Calculator.

If you invest Ksh 5,000,000 in treasury bonds at an interest rate of 18.454% which is the current value as of 3/01/2024 then in one year you will make a profit of Ksh 922,700 from the treasury bond.

And that ladies and gents is how you make money with treasury bonds in Kenya. Keep in mind that this is the real-world scenario.

The fixed coupon you see in the calculator is a fixed interest rate which helps you in knowing the exact amount you will get from the bond.

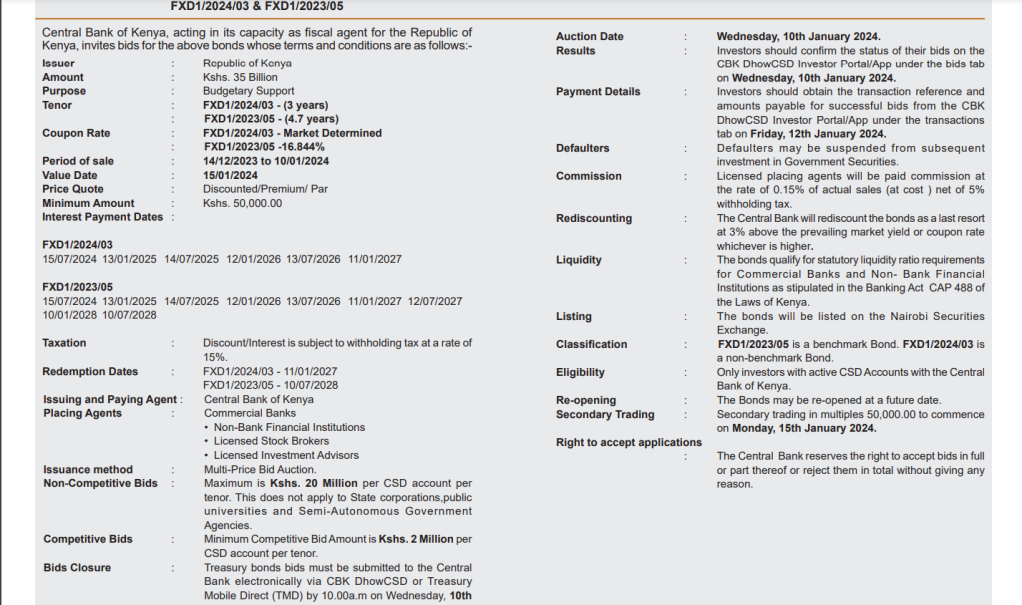

If you buy a three-year bond today the next payments will be in

15/07/2024

13/01/2025

14/07/2025

12/01/2026

13/07/2026

11/01/2027

You can get more information on buying treasury bonds and understand the bonds that are on offer on January 2024 but ensure that you work fast as the deadline is on 10th January 2024.

Are Treasury bonds a good investment in Kenya?

They can be a good investment because of the fixed rates accumulating over time.

Many Kenyans often resort to rental income, which has an average of 7 to 12% income rate.

In comparison, something like infrastructure bonds has a 12% and according to today’s rate of 18.454% makes investing in bonds more lucrative than investing in other typical businesses, and it is also hustle free and you can do it from anywhere in the world without running the risk of someone playing with your money.

Consider the fact that the government issues bond every month. If you were to purchase them for the next twelve months, you would get interest payments every month.

So, for example, you can buy bonds worth 100k for five years for an interest rate of, let’s say, 10% per year/annum.

It can be paid bi-annually (after six months) so that you will get 5% in six months and the full 10% after the year has ended.

Then once the five years have ended, the government will pay you the amount you invested, in this case, the 100k.

During this period, you will have gotten an additional 50k, which is from the 10% interest rate.

So in the five years you will have 50,000 in profit. Now imagine if you invested 1,000,000 and so on.

Remember that the regime does not matter, so even if your bond is due to mature in twenty years, you will still get it despite who the president is.

How to buy treasury bonds in Kenya

The Central bank of Kenya normally auctions their treasury bonds throughout the year, so if you are in the market for some, keep checking their website for any auctions.

The bonds are auctioned every month. These are the steps you need to go through to buy a bond.

Open a CDS account

First, you need to open a CDS account with the central bank of Kenya (it is free to open one). After that, you can now invest in treasury bills or bonds.

Things you need to open a CDS account

- National ID

- Pin certificate

They will respond in two weeks with your CDS account number.

You also should have a bank account with a Kenyan commercial bank. Then collect a mandate card from the central bank or its branches. Provide all the necessary information required and give your contact information.

Also, you need to provide two signatories from your bank who will verify the information you provided.

When submitting your mandate card, you must provide a passport-sized photograph which should be stamped and certified by an official in your bank.

You will then submit your national identity card, passport, or alien certificate.

Then complete and Submit an Application Form.

Once you are ready to invest, you will need to submit a Treasury bond application form which will contain

- The bond you intend to purchase

- The issue number

- The duration

- The amount of money you want to use in your investment

- Your info, including your CDS account number

- The source of your funds (whether they are from offshore or sourced locally)

In the application form, you can select the rate, which will be the percentage of your money investment you will receive as interest payments.

If the bond already has a predetermined coupon rate, then you select Non-Competitive/Average Rate. If the coupon says the rates are market-determined, they choose either the Interest/Competitive Rate or the Non-Competitive/Average Rate.

If you choose the former, you can bid on the bonds by submitting the coupon rate you would like for that particular bond.

The CBK then decides which bids it will select based on the rates, and the average of these rates will be used to calculate what the Non-Competitive/Average Rate investors will receive.

The last section of the application form includes the rollover instructions. Investors with maturing bills will have the opportunity to use their returns to make future investments.

Ensure that you submit your application on the Tuesday of the last week of the bond’s sale period.

The Auction Results

The auction results will be published on Treasury Mobile Direct (TMD), Twitter and in our statistics section on the CBK website.

Note that the CBK has the right to offer lower amounts.

You will then need to call or visit the CBK to know what amount you must pay.

Payment

The payment period will close on the following Monday after the auction. You can pay through a banker’s cheque or cash for amounts under Kshs. One million and through a KEPSS transfer for more significant amounts.

Maturity Proceeds

After the investment, you will receive the interest payments in the account you selected through the bond’s tenor.

Upon maturity, you will then receive the total payments. Alternatively, you can also select to use these returns for a new bond purchase, and if so, you should provide the rollover instructions and submit it to the CBK.

What you need to know if you want to invest in treasury bonds

First, you must decide on the bonds you want to buy and how long you want to commit to these bonds.

Types of bonds

Fixed coupon treasury bonds

This type of bond means that the interest rates will be fixed, and the semiannual payments will remain the same. The government can charge a 10% tax on your interest payments with a two to ten years maturity period.

10% tax on those between 10 to 30 years.

Infrastructure bonds

These are restricted to specific government projects. They can bring in good returns because they are exempted from taxation. They also have a 12 or 12.5% interest rate which is lucrative.

Zero coupon bonds

These are similar to treasury bills; the difference is that they are sold at a discount but have no interest rates. Also, they are issued for a short period.

When you are ready to invest, ensure you are looking for upcoming prospects here. They will provide information about the bonds on offer, their duration till maturity, and the coupon rates.

Coupon rates are interest payments that you will receive after every six months. The rates can be determined in the prospectus or by the market.

Moreover, there you will find information on when the investors will receive the interest payments and how much tax the returns will be subjected to.

If you have a popular one, you will also get information on when the bond is expected to have a considerable investment.

Corporate bonds

We also have these types of bonds, which are issued by private entities such as

- Safaricom

- Mabati Rolling Mills

- Consolidated Bank

Nonetheless, there are some problems with such bonds because a bank once offered corporate bonds but went under, so investors have been skeptical of these types of bonds for fear of losing their investments.

What is the interest rate on Treasury bonds in Kenya? T bill rates Kenya

| Key Rates | ||

| Central Bank Rate | 8.75% | 30/01/2023 |

| Inter-Bank Rate | 6.99% | 13/03/2023 |

| CBK Discount Window | 14.75% | 30/01/2023 |

| 91-Day T-Bill | 9.742% | 13/03/2023 |

| REPO | 0.00% | 20/02/2023 |

| Inflation Rate | 9.23% | February,2023 |

| Lending Rate | 12.67% | December,2022 |

| Savings Rate | 3.56% | December,2022 |

| Deposit Rate | 7.17% | December,2022 |

| KBRR | 8.9% | 27/07/2016 |

Minimum amount to invest in treasury bonds in Kenya

You need to have a minimum of Kshs. 100,000 to buy a treasury bill. Their maturity ranges from one year to 30 years. If you need to add to your portfolio you do that in multiples of 50,000.

How do Treasury bonds make money in Kenya? How do you profit from Treasury bonds?

Since the treasury bills are sold at a discount, you pay less than the face value, but after 91 days, you get the total face value.

You can also sell them at a higher price and generate profits. So, for instance, if you decide to sell through secondary trading at better interest rates, you get capital gains.

What are the disadvantages of investing in Treasury bills?

They are known to generate lower payments as compared to other sources.

Risks associated with treasury bonds

Bonds normally reduce in value when the interest rates increase. So if you have a bond that is long-term, there is a risk that the interest rates will increase, and that means that the bonds you have invested in will have lost their value.

Secondary trading Kenya

This occurs when you have gone through the primary auction in the bond process but you want to sell it after it has been issued to you.

In such a case, you can tell your stock broker of choice you want to sell, after which they will get a buyer, and you can get your money back. This also shows you that you can purchase bonds through secondary trading.

How to open a CDS account while in the diaspora

Your bank can allow you to have a custody account at a fee regardless if it is NIC, KCB, or any other bank in Kenya. So the instructions on bonds will be done through your bank.

Difference between T Bills and Bonds

T bills are short-term (91 days, 182 days, and 364 days). Whereas treasury bonds usually have a longer period before maturity.

Closing

Treasury bonds can be a good investment option. The interest payments increase with increase in the years it takes for the bond to mature.

So if you have some money lying around, please visit the nearest CBK branch, open your CDS account, and start the journey toward getting high-paying bonds.

Also, look for some, such as m Akiba, which requires a low initial investment.

Leave a comment